37+ are mortgage payments tax deductible

Get Online Answers in Minutes. Web As seen above a fully tax-deductible mortgage would occur once the last bit of principal is borrowed back and invested.

2001 2005 Coon Hill Road Skaneateles Ny 13152 Mls S1361955 Howard Hanna

As noted in general you can deduct the.

. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. The debt owed is still 100000.

For tax years before 2018 the interest paid on. Connect Online Anytime for Instant Info. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Find A Lender That Offers Great Service. Web Mortgage balance limitations The IRS places several limits on the amount of interest that you can deduct each year. Ad Ask a Tax Expert About Tax Deductible Limits.

Web Late payment charge on mortgage payment. If you refinanced the points you can deduct are divided up over the. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Web Why cant you deduct your full mortgage payment on Schedule E. Web If you just purchased your home you can deduct all of the points you paid in the same tax year. Generally it must be acquired to protect the lender from borrower default and is usually paid as a one-time.

You can deduct as home mortgage interest a late payment charge if it wasnt for a specific service performed in. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. Compare More Than Just Rates. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Web Mortgage insurance payments are tax deductible through 2021 but the deductions phase out if your adjusted gross income exceeds 100000 50000 for married people. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill.

Ask a Verified Tax Accountant How Tax Deductibles Work. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your. Web 2 days agoWhen it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on.

I know that on schedule E your deductions are limited to mortgage interest property taxes maintenance. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Homeowners who are married but filing.

Web For the 2019 tax season standard deductions are. Web Is mortgage insurance tax-deductible. 12200 for those who are single or married and filing separately 18350 for those filing as the head of the.

Web In most cases mortgage insurance payments are not tax deductible. For taxpayers who use. Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec.

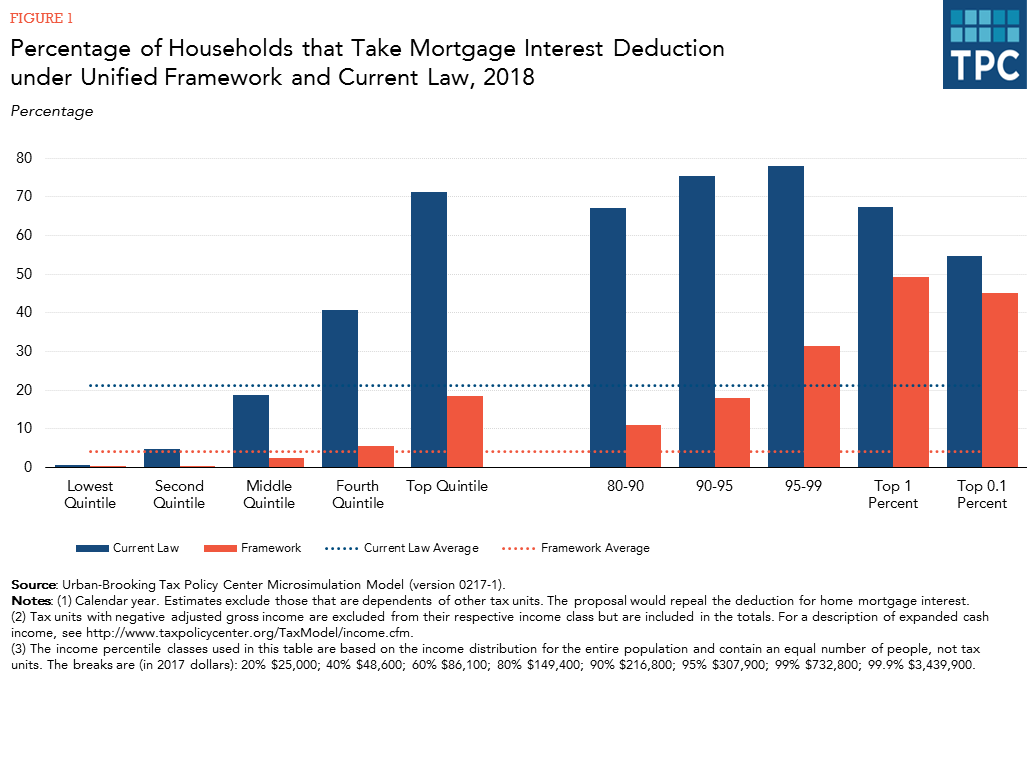

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Gutting The Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction Changes In 2018

Personal Finance Apex Cpe

Faq Are Mortgage Payments Tax Deductible Hypofriend

10 Steps Toward Home Ownership Mortgage 1 Inc

Faq Are Mortgage Payments Tax Deductible Hypofriend

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

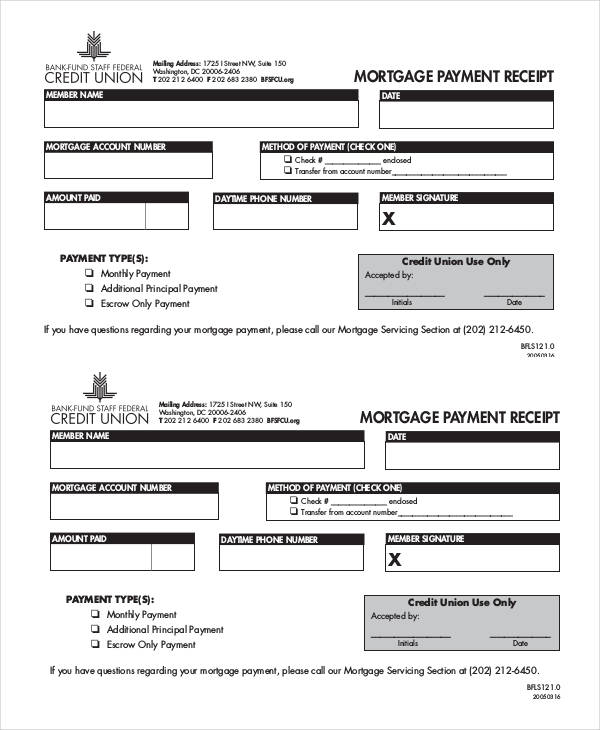

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Credit Union

Free 37 Sample Receipt Forms In Pdf Ms Word Excel

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Expenses Can Be Deducted From Capital Gains Tax

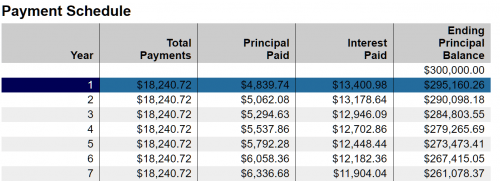

Mortgage Interest Deduction How It Calculate Tax Savings

10 Steps Toward Home Ownership Mortgage 1 Inc

Learn How The Student Loan Interest Deduction Works

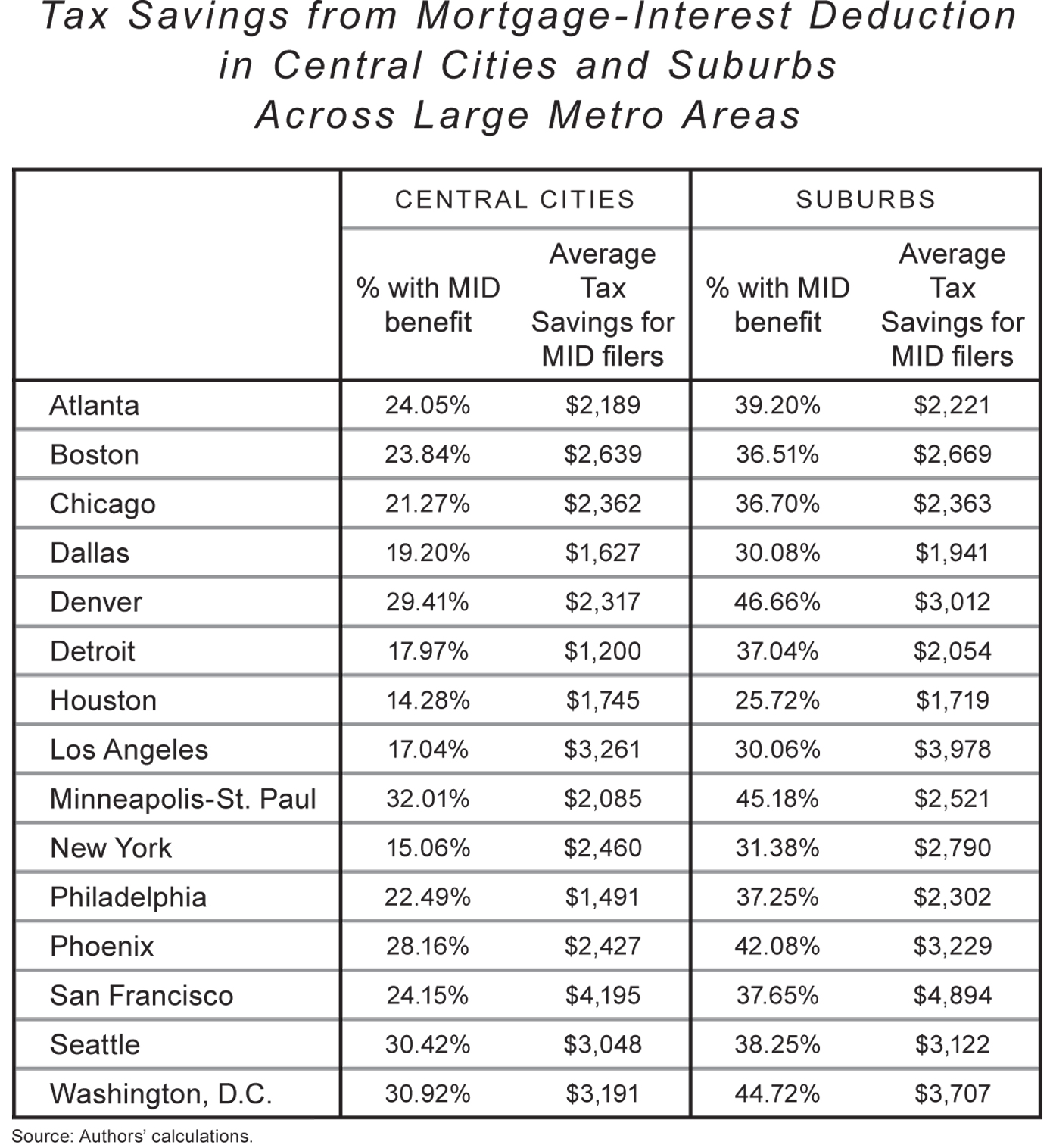

Rethinking Tax Benefits For Home Owners National Affairs

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep